am i taxed on stock dividends

200000 or more for single individuals. You do not pay tax on any dividend income that falls within your Personal Allowance the amount of income you can earn each year without paying tax.

How You Can Still Earn Money Even If The Market Is Falling Click The Photo To Learn More Ideas Stockmarket Fina Stock Market Investing Strategy Marketing

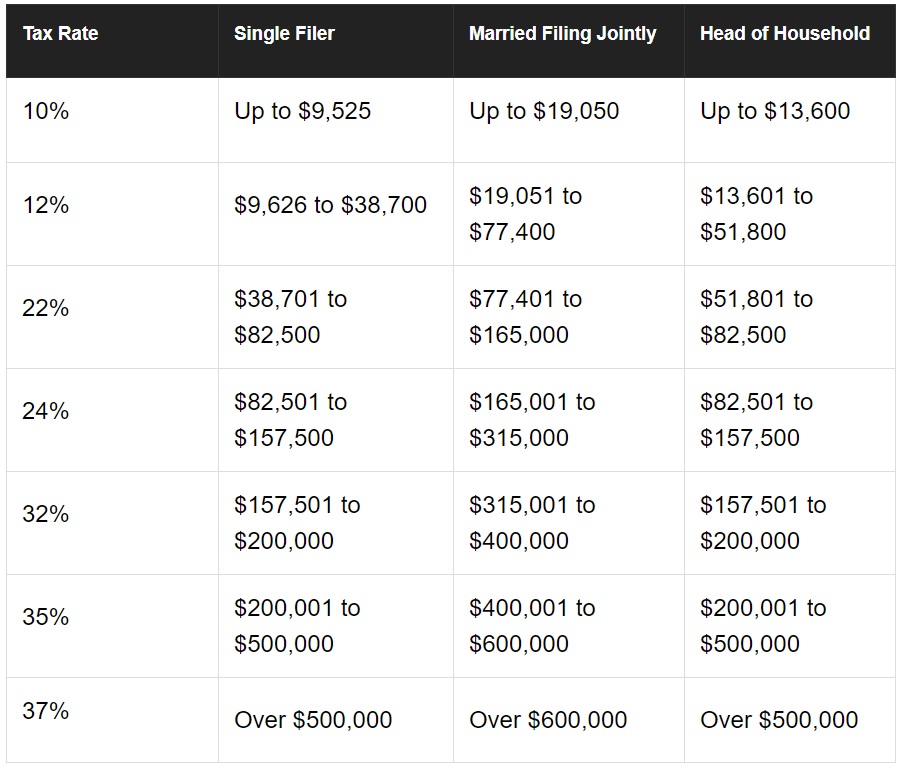

Then the Tax Cuts and Jobs Act TCJA came along and changed things up effective January 2018.

. Investors in the highest tax bracket pay tax on capital gains at a rate of roughly 27. The rate depended on the taxpayers ordinary income tax bracket. How much dividend is tax free in UK.

The Growing Power of Dividends. Qualified dividends are taxed at. To see why you should have a stocks and shares ISA check out Trading 212 Invest vs ISA.

It is taxed at 396 percent for dividends that are not considered to be eligible dividends both numbers are for the highest income tax bracket. Because of a Tax Treaty between the United Kingdom and the United States UK dividends are taxed at preferential rates rather than the standard 396 percent tax rate. Even if you include the 38 net investment income tax for married couples filing jointly and who are earning 250000 or more 125000 or more for married couples filing separately.

The qualified dividend tax rate. Ordinary dividends are taxed at regular income tax rates rather than at capital gains rates. Qualified dividends however are taxed at lower capital gains rates with a maximum of 15 percent.

At all levels dividends can be taxable federal provincial and municipal. For retirement accounts stock dividends are not taxed. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent.

And 250000 for a qualifying widow with a child this. This amount is in addition to the Personal Tax-Free Allowance of 12570 in the 202122 tax year and the 12500 in the 202021 tax year which means you can earn up to. Best Dividend Capture Stocks Quickest stock price recoveries post dividend payment.

In case you have an eligible dividend you are subject to a tax of 298 on the tax portion plus a 9 percent charge. However they are often confused on how PIK dividends are taxed. A TFSA is designed to hold Canadian securities although it doesnt deny you from holding foreign securities in this account.

A history of our dividends and required IRS disclosure regarding dividend characterization are outlined below. Investors in the highest tax bracket pay tax of 39 on dividends compared to about 53 on interest income. Yes on US stock you will always be taxed on the dividends.

For stock dividends it depends on the type of account. If youre in the 10 to 15 percent bracket then youre not going to be taxed anything on qualified dividends. Your tax bracket alone is going to influence your qualified dividends tax rate.

To be qualified the dividends must meet certain criteria such as they must be paid by a US. 12857 based on this years estimates. 40001 for those filing single or married filing separately 54101 for head of household filers or.

While that isnt new news you also are taxed on 15 of these dividends in your TFSA which is a Canadian withholding tax on dividends. Dividends are not subject to yearly taxation because they are deposited into a Roth IRA instead. Below are some simple but non-exhaustive key points.

For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. Corporation or qualified foreign corporation and you must have held the stock for. And heres something nice.

Issuers of corporate securities are required to complete Internal Revenue Service Form 8937 to report organizational actions. Qualified dividend taxes are usually calculated using the capital gains tax rates. RYN announced today the tax treatment of the Companys 2021 dividend distribution on its Common Stock CUSIP 754907103.

Noneligible dividends are subject to a 3 tax rate. This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. There is a 15 percent application rate by the Canada Revenue Agency.

Qualified dividends were taxed at rates of 0 15 or 20 through the tax year 2017. Capital gains taxes are very similar to those incurred when buying United States-domiciled stocks. Antero Midstream Corporation NYSE.

Instead youll pay only when you withdraw money from the account. The Canadian government imposes a 15 withholding tax on dividends paid to out-of-country investors which can be claimed as a tax credit with the IRS and is waived when Canadian stocks are held in US retirement accounts. At 100000 of income the Canadian dividend tax rate range is 15 to 29 versus 36 to 46 for US.

On your UK stocks fear not your ISA is tax-free for both capital gains and dividends. However do not let the 15 tax put you off investing in the US economy it will be your downfall if you do. Stocks is to hold their US.

WILDLIGHT Fla--BUSINESS WIRE-- Rayonier Inc. Currently the maximum tax rate on qualified dividends is 20. The rates are set at 0 15 and 20 just as they have always been.

Stocks in retirement accounts which simulataneously reduces their tax burden and dramatically reduces the tax complexity of their investment portfolios. The dividend payout ratio for AM is. 80801 for married filing jointly or qualifying widower filing status.

If you reinvest your dividends you still pay taxes as though you received the cash. To summarize heres how dividends are taxed provided that the underlying dividend stocks are held in a taxable account. 13043 based on the trailing year of earnings.

In a non-retirement account qualified dividends are taxed at. Common stock PIK dividends generally are not taxable to the recipient under IRC Section. Stock dividends are generally not taxable until the stock is sold.

I want to make mention that you pay dividend tax on stocks held on US. AM makes quarterly cash dividends to its shareholders. The tax rules that apply to PIK dividends depend on whether the PIK dividend is paid on common stock or preferred stock.

Qualified dividends are taxed at the long-term capital gains rate of 20 in nonretirement accounts. 7040 based on cash flow. Dividends Our recommendation for Canadian investors looking for exposure to US.

You wont pay taxes on dividend income as it comes in. 11111 based on next years estimates.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

The Ultimate 5 Step Guide To Maximizing Your Index Etf Returns Young And Thrifty Trade Finance Business Finance Finance Goals

Tax Implications Of A Dividend H R Block

Your Money Know How Dividend Income Is Taxed The Financial Express

I M A Powerful Money Magnet Money Magnet Wealth Creation Wealth

Indian Rupee Gold Coin Stack Royalty Free Illustration Gold Coins Gold Bullion Today Gold Price

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Structure Business Investment

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Investment Accounts