bexar county tax office pay online

Bexar County Tax Assessor-Collector Albert Uresti Bexar County TX - Official Website. Ways to file.

Property Tax Information Bexar County Tx Official Website

Offered by County of Bexar Texas.

. Pay your property taxes online. The Bexar Appraisal District highly encourages everyone to create an online services account to have quick and convenient access to these services. 233 N Pecos La Trinidad San Antonio TX 78207 Mailing Address.

Our office is responsible for over 14 million vehicle registrations per year and for collecting over 25 billion in taxes in a fair and equitable manner. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. By mail at Bexar Central Appraisal District PO.

Please allow up to 15 days for the processing of your new window sticker or new plates by mail. Box 839950 San Antonio TX 78283-3950. 411 North Frio Street.

You can create a portfolio if you want to group multiple tax accounts together for easier review and payment. Forms sent by mail will. For convenience Taxpayers can now request to receive their Property Tax Statement via email.

Please select the type of payment you are interested in making from the options below. You can search for any account whose property taxes are collected by the Bexar County Tax Office. Our office is committed to providing the best customer service possible for all our citizens.

Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online. Property Tax Payments Online. The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH.

Bexar Central Appraisal District. After locating the account you can also register to receive certified statements by e-mail. 2022 data current as of May 14 2022 115AM.

Box 839950 San Antonio TX 78283-3950 Telephone. Bexar County Tax Assessor-Collector Office P. Paying your County Property Taxes online by either mailing a check or using one of the online options offered by the Bexar County Tax OfficeYour bank account will be billed as long as your payment is not cleared.

The Online Portal is also available to agents that have been authorized to represent an owner under section 1111 of the Texas Property Tax Code. After locating the account you can pay online by credit card or eCheck. Click here to register online on TxDMV website.

How was your experience with papergov. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Acceptable forms of payment vary by county.

As part of this interlocal agreement the City of San Antonio also manages bill collection and collection of its taxThe intersection of Pleasanton Rd and Southside is situated. After logging in to your portfolio you can add more. Bexar County Tax Office.

411 North Frio Street San Antonio TX 78207 Mailing Address. Search accounts whose taxes are collected by Bexar County for overpayments. For questions regarding tax amounts visit the County Tax Office Website email or call 210 335-2251.

You can send us your protest by mail at. Bexar County Tax Assessor Collector has 35 stars. Thank you for visiting the Bexar County ePayment Network.

Monday - Friday 8AM - 5 PM. Please contact your county tax office or visit their Web site to find the office closest to you. Albert Uresti MPA Physical Address.

Box 830248 San Antonio 78283. San Antonio TX 78283. After locating the account you can also register to receive certified statements by e-mail.

You may stop by our office and drop your protest in our dropbox located in the front of the building. San Antonio TX 78207. In addition to billing and collecting City of San Antonio Property Taxes the Bexar County Tax Collectors Office is also providing property taxes collection services.

Other locations may be available. Tax Bills Who to Contact for Tax Bills. Welcome to the Bexar County.

Search for any account whose property taxes are. Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified owner and current year and total amounts due. BCSO Calendar of Events.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. County tax assessor-collector offices provide most vehicle title and registration services including. May 5 2022 20553 AM.

For property information contact 210 242-2432 or 210 224-8511 or email. Your property tax burden is decided by your locally elected officials and all inquiries concerning your local taxes should be directed to those officials Property Search Data last updated on. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

Everything You Need To Know About Bexar County Property Tax

Bexar County Tax Assessor Collector 30 Reviews Tax Services 233 N Pecos La Trinidad San Antonio Tx Phone Number Yelp

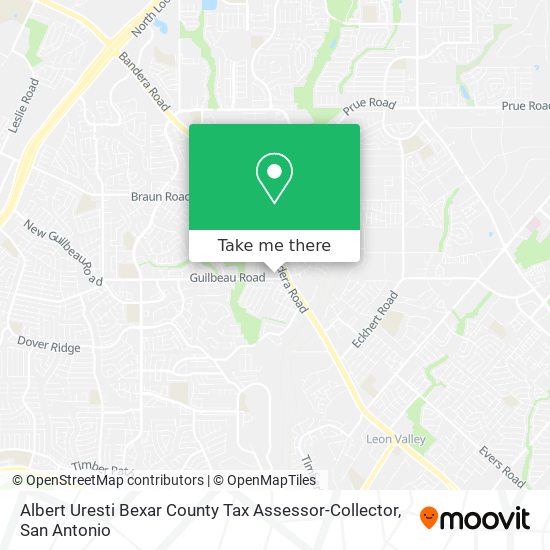

How To Get To Albert Uresti Bexar County Tax Assessor Collector In San Antonio By Bus

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Real Property Land Records Bexar County Tx Official Website

Cash Strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County County

Bexar County Jail Seeks More Female Guards San Antonio News San Antonio San Antonio Current

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Bexarcounty Bexar County Texas Logo Transparent Png 700x700 Free Download On Nicepng

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

News Flash Bexar County Tx Civicengage

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Bexar County Commissioners Approve Funding For Uh Public Health Division Homestead Property Exemption Tpr

Payments Bexar County Tx Official Website

San Antonio Based Tech Company Says It Can Speed Up Homeowners Ability To Protest Property Taxes San Antonio News San Antonio San Antonio Current